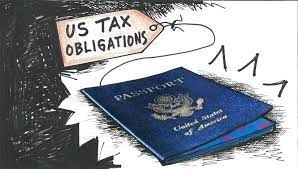

Understanding US Tax Responsibilities in Hong Kong

For U.S. citizens residing in the vibrant city of Hong Kong, navigating the complex realm of U.S. tax obligations is a crucial task. This section elucidates the foundational aspects of understanding and managing U.S. tax responsibilities while living abroad, addressing the unique challenges faced by American expatriates in Hong Kong.

Expert Strategies for Expatriate Tax Planning

Expatriate tax planning is a key aspect of managing U.S. tax obligations while living overseas. Here, we explore expert strategies tailored for Hong Kong residents, including considerations for foreign income exclusions, foreign tax credits, and the intricacies of reporting.

By delving into these strategies, U.S. expatriates in Hong Kong can optimize their financial outcomes while ensuring compliance with both U.S. and Hong Kong tax regulations.

The Role of Tax Treaties in US-Hong Kong Relations

Understanding and leveraging tax treaties becomes paramount for U.S. expatriates facing dual taxation. This section outlines the significance of tax treaties in mitigating the impact of double taxation, elucidating the relief mechanisms and jurisdictional considerations between the U.S. and Hong Kong.

A comprehensive understanding of these agreements is vital for U.S. expatriates to navigate the complex tax landscape effectively.

Seeking Professional US Tax Advice in Hong Kong

Given the evolving nature of tax regulations, seeking professional advice is essential. In this segment, we emphasize the importance of engaging U.S. tax advisors in Hong Kong. These professionals specialize in expatriate tax matters, providing personalized guidance, ensuring compliance, and offering peace of mind to American expatriates as they navigate the intricate tax landscape in Hong Kong.